For those of you who frequent my blog would know that I am not a trained personal finance planner. Whatever I write are just my opinions only. As usual, I write with a little bit of common sense, some dry cold hard number analysis and a little bit of personal experience/observations.

I have [been] managing my own money for most of the time. So, I don't talk to [a] financial planner about a topic like how much do I need so that I can retire. What is retirement anyway?

My definition of retirement is

"accumulated capital" that generate sufficient "passive income" to fund "expenses" till the end of life.

Three key words - "accumulated capital", "passive income" and "expenses".

Mathematically, it can be expressed as follows

accumulated capital x return on investment = passive income

if we do not want to touch on our accumulated capital, then

expense must be lesser or equal of passive income. Just this simple.

To figure out how much is the accumulated capital, there are two questions we must answer

1. what is my expected expenses?

2. what is expected return on investment?

The answer to the first question is very important and the most difficult one. It involves economics as well as psychological considerations. Psychological aspect however drives the economics decisions. I am afraid that I might have to go to touch on even more abstract stuffs like what is our philosophy of happiness. Do we need a lot stuffs to make us happy? Do we need to flash a lot of stuffs to feed our big bad hungry egos?

I can't comment on rich and famous lifestyle because I never experience one like driving a Ferrari or drinking Lafite or eating a meal of truffle. Things are most familiar to me are like nasi lemak, roti canai, Hokkien me, char koey teow, teh tarik and etc....for most of the time, spending RM 50 by going to wet market is enough stocking up my refrigerator for a week. Occasionally, going over friends house, heating up a charcoal stove and make some "purr err" tea is good enough for us to chat about almost everything under the heaven till wee hours. For most of the time, it's just a little bit of reading, internet surfing and taking care of housework. With this kind of lifestyle plus taking away the child support, parent support, subtract the petrol and toll fees(savings from commuting to works), eating outside, cut off the mobile broadband, etc....I imagine my overhead will be pretty low if I don't work.

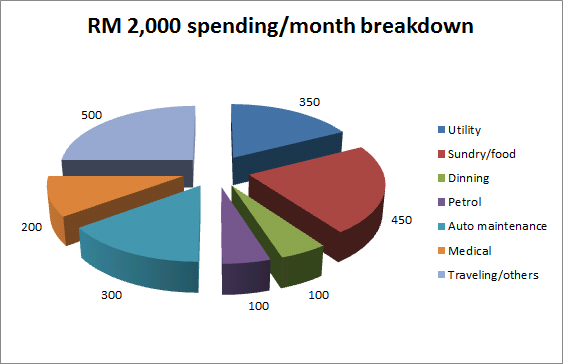

For a person who is debt free(no more housing and auto loans), I think RM 1,500 to RM 2,000 will be more than enough for me. This chart is just I would budget my RM 2,000. Please note, I budgeted average almost RM 500/month(RM 6,000/year) for traveling if no surprises coming up to compete for this fund. If something happen, sorry-lah - no traveling that year.

I think a person who occupied mostly with daily mundane routine, RM 24,000 a year will be enough.

Once we get over the "expense" stage, solving the rest of the equation will be easy. The next is deciding "return on investment".

Risk free = 3.5% in fixed deposit

Low risk = 5.5% bond

Medium risk = 7% REIT or dividend stock

High volatility(NOT high risk) = Equity 10%

If a person is very risk adverse, allocate 100% of their "capital" in FD, the required capital will be

RM 24,000 / 3.5% = RM 685, 714

If a person has stronger stomach = 30% FD, 20% bond, 30% REIT or high dividend stocks and 20% equity, the expected return on investment from this combo will be 6.25%. The required capital will be

RM 24,000/6.25 = RM 384,000

The range that we are looking at is somewhere RM 380,000 ~ RM 685,000.

To hit RM 685,000 by the age of 45, at 10% expected rate of return, this workout to be around RM 892/month. Not too far from this portfolio saving of RM 888/month. To save up RM 892/month by assuming saving 20% from his/her salary, a person would need a job of RM 4,500/month roughly. This will leave a person roughly RM 3,105/month to cope with the rest of expenses.

It's very tough but not impossible to be retired by the age of 45 but there will be lots of sacrifices during younger age and work like hell to make at least average of RM 4,500/month for 20 years. Please note that I excluded EPF savings as a margin of safety to fund children education. With average of RM 900/month savings from EPF, at 5% CAGR return, this will leave a person roughly RM 372 k after 20 years. Arithmetically, a person can be a millionaire(685 k + 372 k) by the age of 45. This a very frugal way that I know that can be done. The million ringgit question is do salaried men/women have this kind of will power and stamina to see their goal become reality?

Saturday, January 18, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment