Anyway, I certainly feel that we have passed the Thrill stage but about to reach Euphoria stage in the investor sentiment cycle.

First most people certainly feel that they are very smart. I recently came across some data from Fundsupermart

2014 has been a good year for investors so far, with funds on the platform averaging a 4.9% year-to-date return at “half time”. Of the 150 equity funds we cover on our platform, 126 (84%) equity funds recorded positive returns in 1H 2014. |

Those who buying equity funds at the beginning of the year would have 84% chance of making money. 84% is very very good and certainly will make people feel smart.

Despite of most people feeling they are smart, they are still feeling cautious. Retail participation certainly had improved a lot. 30% participation is not bad. To reach Euphoria stage, I would think it has to reach may be 40-50% for at least 6 - 9 months strech. In fact, retail investors have been quick to flee the moment they see something is wobbling and they have been net sellers for a while(profits taking) recently.

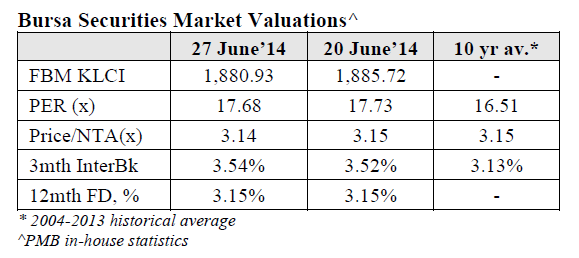

The KLCI market is already above the 10 years long term average but it has not reach may be around 18 to 20 times PE yet to be in the Euphoria stage.

The bull is aging but the chance of potential to over-shoot will remain high. We will see more of Euphoria phenomena when we begin to see laggards like China market begin to revert above their long term valuation. For now, I think people will still chase price.

The rhyme seems pretty familiar to me. In the late cycle bull run prior to 2007 worldwide peak, the Chinese market were going no where for many years and suddenly the energy just burst and tripped within 12 months.Here is the chart of Shanghai Stock Exchange. See from 1997 to 2006, nothing was moving and it went wild completely in a short time.

This post is not to encourage people to lead people to think we have another 12 months rally to go. But to remember:

BE FEARFUL WHEN OTHERS ARE GREEDY!

1 comment:

The problem is, nowaday too many people are cautious. And when cautious, I don't think market will fall. Also people learn that even in the worst of market, market still will rebound. So probably less panic seller nowaday.

Post a Comment