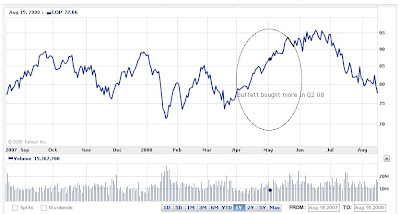

It is a little bit unusual to me that Buffett bought at all the time high or he simply think this is not a bubble and just a temporary peak and the bull will continue to run?

(Reuters--NEW YORK) Billionaire Warren Buffett's Berkshire Hathaway Inc took a stake in NRG Energy Inc, the second-biggest power producer in Texas. Mr Buffett also made an undisclosed transaction involving ConocoPhillips, the second-largest US refiner.

Berkshire had 3.24 million NRG shares as at June 30, the Omaha, Nebraska-based company said on Thursday in a regulatory filing disclosing equity investments at the end of the second quarter.

'It would be logical for him to increase his utility and energy holdings and NRG would fit in nicely,' said Frank Betz, a partner at Warren, New Jersey-based Carret Zane Capital Management, which oversees US$800 million, including Berkshire shares.

'There's exponentially increasing demand for energy and power.' Mr Buffett, ranked the world's richest man by Forbes magazine, built Berkshire from a failing textile manufacturer by investing premiums from insurance subsidiaries such as Geico Corp in out- of-favour securities and buying businesses whose prospects and management he deemed superior. Berkshire spent US$3.98 billion on stocks in the quarter, more than twice the investment from the previous three months, separate filings show.

http://www.businesstimes.com.sg/sub/news/story/0,4574,292579,00.html?

When George Soros came out of his retirement to ensure that his wealth is not destroyed by the deleveraging environment. I was at first suspected that he is out of touch. However, he is actually doing quite all right as he broke even last year -- shorts on the US market paid off but gains offset by his emerging markets bets. However, again, buying energy at all time high is unusual to me. What is shocking he has been saying this is a bubble yet he stepped in? Why?????

Aug. 15 (Bloomberg) -- Billionaire investor George Soros bought an $811 million stake in Petroleo Brasileiro SA in the second quarter, making the Brazilian state-controlled oil company his investment fund's largest holding.

As of June 30, the stake in Petrobras, as the Rio de Janeiro-based oil producer is known, made up 22 percent of the $3.68 billion of stocks and American depositary receipts held by Soros Fund Management LLC, according to a filing with the U.S. Securities and Exchange Commission. Petrobras has since slumped 28 percent.

http://www.bloomberg.com/apps/news?pid=20601086&sid=aLW16QIlRoWI&refer=latin_america

Jim Rogers. He is absolutely bullish about commodities. However, having watching him, you need to be careful as he likes to buy when everybody absolutely hate it. However, when he is bullish, it does not mean an outright buy. Let me give you an example, he was bullish on Taiwan market at the beginning of the year -- BUT -- he did not buy Taiwan market yet. You will absolutely got excited with his bullishness when watching him appearing on TV. Guess what, Taiwan Index falls by almost 20 plus percent and now he said he is watching for the right time to enter. I suspect his buy trigger will be ON when Shanghai Index falls to around 2,000 points or less.

He has been absolutely positive saying he does not like to buy oil at all time high for a while ( a year may be??) What is more interestingly, he came up to CNBC said he is buying airlines which indicating oil will fall -- 50% off???.

Boone Pickens bets crude oil will not drop below $100.

"I don't think it'll drop below $100," Pickens told Reuters in a telephone interview. "I would say $110 is where it might go, something like that."

Another contrarian, Marc Faber has been telling his newsletter readers to buy airlines since beginning of July betting crude oil will fall. Well, crude oil fall it did.

"Prices have made a peak,'' said investor Marc Faber, who publishes the Gloom, Boom & Doom Report.

"Whether that is a final peak or an intermediate peak followed by higher prices, we don't know yet. It could go lower,'' he said by phone today from Chiang Mai, Thailand.

I am taking Marc's view for now, when the bulls and bears are fighting, just don't stand in the the middle of the fight. Additionally, we are in a deleveraging environment. Just wait-and-see.

1 comment:

Could these indicate the high commodities price especially for energy types was actually due to supply and demand??

The CFTC reported that there is no oil price manipulation.

In addition, 2 months ago, some steel producers willing to pay for ore price for about 80% increase

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aBQ_nIZ6uiug

I think that steel and oil are correlate in term both are needed for development.

Post a Comment