Wednesday, August 31, 2011

Pu Chai rue Pu Yin?

Monday, August 29, 2011

What's up Vincent Tan?

Friday, August 26, 2011

What's up Khoo Khay Peng?

The Best Buy Signal in 53 Years

(Investment U)

In the first half of the twentieth century, investors found that if you bought stocks only when the market's yield exceeded the yield on 10-year Treasuries, you would have been in for every single major rally........As I write, the 10-year Treasury is yielding 2.07 percent. The S&P 500 yields 2.16 percent. Of course the S&P 500 Index was only created in 1957. It was the Dow that investors used in the first half of the last century. And the yield on the Dow is more than 50 percent higher at 3.24 percent.If history is any guide, that means stocks are a terrific long-term "Buy" right now and Treasuries - which have become a complete bubble and a table-pounding "Sell" in my estimation - are due for a long period of underperformance.

True, GDP growth is likely to be anemic in the months ahead. But - shocking and surprising most investors - stocks (and especially dividend-paying stocks) should do exceptionally well.

There are no guarantees in the world of stock market investing, of course. But as Patrick Henry famously said, "I know no way of judging the future but by the past."

Good investing,

Alexander Green

Thursday, August 25, 2011

Thanks, Steve Jobs

Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things. They push the human race forward. And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.

(WSJ) Steve Jobs, the ailing tech visionary who founded Apple Inc., said he was unable to continue as chief executive of the technology giant and handed the reins to Chief Operating Officer Tim Cook.

Apple said Mr. Jobs submitted his resignation to the board of directors on Wednesday and "strongly recommended" that the board name Mr. Cook as his successor. Mr. Jobs, 56 years old, has been elected chairman of the board and Mr. Cook will join the board, effective immediately, the company said.

"I have always said if there ever came a day when I could no longer meet my duties and expectations as Apple's CEO, I would be the first to let you know," Mr. Jobs said in his resignation letter. "Unfortunately, that day has come."

Wednesday, August 24, 2011

Short one

Monday, August 22, 2011

Sunday, August 21, 2011

3 Amazing find

Thursday, August 18, 2011

3 Stocks to investigate

Tuesday, August 16, 2011

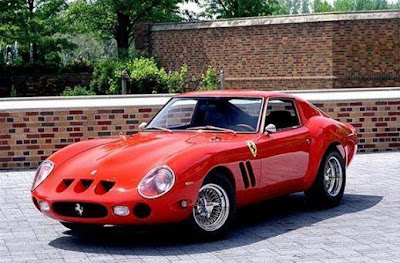

12 Most Expensive Vintage Cars

1. ALFA ROMEO 8C 2300 MONZA SPIDER CORSA – $2.53 MILLION

2. MERCEDES-BENZ 540K SPECIAL ROADSTER – $3.63 MILLION

3. 1937 BUGATTI TYPE 57S – $4.4 MILLION

4. SHELBY COBRA DAYTONA COUPE – $4.4 MILLION

5. 1930 BENTLEY SPEED SIX – $5.1 MILLION

6. 1953 FERRARI 340/375 M BERLINETTA COMPETIZIONE – $5.8 MILLION

7. ALFA ROMEO 8C 2900 – $4.07 MILLION

8. 1962 FERRARI 250 GTO – $6.2 MILLION

9. ROLLS-ROYCE 10HP TWO-SEATER – $7.25 MILLION

10. BUGATTI ROYALE KELLNER COUPE – $9.7 MILLION

11. 007 ASTON MARTIN DB5 – $5-$10 MILLION

12. 1961 FERRARI 250 GT CALIFORNIA SPYDER – $10.8 MILLION

Monday, August 15, 2011

Adding art to your portfolio

(1) investing in art,

(2) putting money in lower income by rising minimum wage(the new PM of Thailand is pursuing that, China vows to double the minimum wage in 2 years time). Will the multiplier effects work or more of a popularist policy?

(3) classic car collection.

Among the three topics I finally decided to post on item 1. I think it's make sense because hard asset will do better over soft asset in current environment. But it has also its own caveat, guys, gals, never forget caveat emptor.

(Business Times) Art market professionals tell MINDY TAN collecting art is different from investing in art, and that caveat emptor applies in a big way

WHILE art has traditionally been linked to the romantic notions of art-for-art's sake, it has also long been seen as an investment vehicle.

In England, for instance, art auctions date back to the latter part of the 17th century. As testament to the burgeoning art market, Pablo Picasso's Nu au plateau de sculpteur was auctioned for US$106.4 million in May last year; this 1932 painting currently holds the world art auction record.

If you appreciate the finer aesthetics of this asset, this alternative investment might provide that splash of colour to your investment portfolio.

Art pieces

According to Ng Cai Lin, co-founder of Artyii, Asia's leading community for emerging paint artists, investors should familiarise themselves with an artist's provenance (his/her education, exhibition history), the artist's collector community (whether or not they comprise established institutions, museums, or individual art collectors) and the seller to assess their credibility.

'The ability to appraise the fundamental value of an artwork is integral in art investing. This is not a gift, but a skill acquired through experience. Consider if you really need to invest in art to hedge or diversify your portfolio.'

Equally important is to ensure that one has sufficient capital. 'From the moment you start trading in art, there will be hidden costs (in the form of) insurance, specialised transportation and storage. Having capital just for the art will not be enough,' she warns.

Apart from clear-cut risks such as liquidity, other risks unique to this asset include forgery, theft and physical damage, says Ms Lin. She adds that hedging against these risks involves costs such as insurance, restoration and maintenance expenses.

Ser-Keng Ang, senior lecturer of finance at SMU's Lee Kong Chian School of Business adds: 'If you invest in physical art, you need to take into consideration the storage, insuring of, and care of the commodity. Taking care of artwork is very delicate and unless you have the space and environment for it, you might want to consider alternative asset classes.'

Art exchange

In what may be an effort to raise art investments' transparency and enhance investibility, the world's first art exchange was launched in Paris, the city of romance.

Launched by A&F Markets in January, the exchange provides the opportunity to buy and sell shares of famous artworks.

Investors are also able to look at the list of available artworks on the art exchange website, all of which have been authenticated and certified. Each artwork is accompanied by a detailed dossier of presentation, their financial progression, as well as factual information on the artists and the art market in general.

Howard Rutkowski, partner of Fortune Cookie Projects, says: 'The top end of the art market is driven by a variety of factors: rarity and importance of major works, supply and demand and, of course, the capital required to play at the upper echelons.'

While he acknowledges that art can be a valuable investment, he also warns that the factors affecting art are varied, and may be confusing especially for investors used to the objective evaluation.

He says: 'Art can be a valuable investment opportunity for those who know what they are doing, but art is subject to many more variables. It is a subjectively acquired asset that is not weighed against standards that one might find in stock exchanges or other forms of investment.

'There are many examples of a 'hot' artist being acquired by all sorts of collectors. Like the bull in the pasture, the art world moves on and another new thing takes its place. The former darling is no longer so interesting and perhaps not as valuable.'

Adds Wen-Li Tang, representative for Christie's, Singapore: 'Studying auction prices alone gives some insight into the art market. Art.net, the Mei-Moses Art index and Astron.net (Chinese art) are all useful references. In addition, auction house catalogues, many of which can be found online, are also a great resource for information that goes beyond figures, to help collectors understand more about particular works and their background.'

Art funds

Art funds are generally privately offered investment vehicles that acquire and dispose of art works. They are managed by professional art investment managers, or an advisory firm that receives a management fee, and a portion of any returns delivered by the fund.

Mr Ang of SMU says: 'If you invest in these funds, the quality of the manager is very important; credentials are very important because you are basically buying into their expertise.'

Mr Rutkowski of Fortune Cookie Projects adds: 'Art is not as liquid as people like to think. The market is subject to emotion . . . perceptions and a fixed calendar. To unload at auctions, which most art schemes recommend to guarantee 'transparency', is to be at the mercy of an unknown future. Things can change within six months leading up to a sale. Selling privately takes time as well. One just can't hang a 'For Sale' sign on a work of art and expect it to be snapped up for a profit. Furthermore, the bazaar nature of the art market means considerable negotiation: 'You want $6 million? I'll offer you $4 million.' Nobody negotiates other instruments in that manner.'

Ms Tang of Christie's adds that given that pricing indices and performance data analyses are still in the early stages, they may not be widely available across all art categories - a factor that may hamper investors' research.

Is investing in art a good idea for young investors?

Ms Lin of Artyii emphasises that there is a clear line between collecting art and investing in art. She says: 'I do not recommend art investing for young investors, especially those new to art. The ability to appraise the fundamental value of an artwork is integral in art investing. This is not a gift, but a skill acquired through experience.

'Consider if you really need to invest in art to hedge or diversify your portfolio. There are many other hedging vehicles that are less complicated than art.'

Friday, August 12, 2011

News bet against double dip recession.

Buffett bets big against double-dip recession

By Andrew Frye

Billionaire Warren Buffett said he is wagering on continued economic expansion and doesn’t expect a second recession.

“I would bet very heavily against that,” Buffett told Bloomberg Television’s Betty Liu on the “In the Loop” program today after data showed slowing U.S. job growth. “How fast the recovery will come, I don’t know. I see nothing that indicates any kind of a double dip.”

The unemployment rate unexpectedly climbed to 9.2% in June, the highest level this year, and hiring by companies was the weakest since May 2010, Labor Department data showed. U.S. employers added 18,000 jobs last month, less than the 105,000 median estimate in a Bloomberg News survey.

“It means that we’re still a way off from getting to where we should be,” Buffett said in the interview, in Sun Valley, Idaho. “We’re seeing growth around the world, but it’s not mushrooming.”

Buffett’s Berkshire Hathaway Inc. added about 3,000 jobs last year after cutting more than 20,000 positions in 2009. The Omaha, Nebraska-based company employed about 260,000 people at units from insurance and shipping to consumer goods and energy, Berkshire said in February. Employment gained last year at Berkshire units including car insurer Geico and railroad Burlington Northern Santa Fe. Staffing fell at carpet-maker Shaw Industries.

“Jobs come with demand,” Buffett, 80, said today. “We’re seeing demand in a lot of places but we’re not seeing it in the construction field.”

Bricks, Carpet

Berkshire owns a real estate brokerage, a maker of manufactured homes and units that construct roofs and sell bricks and carpet. Buffett said in February that a housing recovery would begin “within a year or so” and that he’s preparing the company’s businesses for growth. Buffett is chairman and chief executive officer of Berkshire.

Berkshire expanded its Acme Brick unit with a US$50-million acquisition, and Johns Manville, the roofing subsidiary, is building a US$55-million plant in Ohio, Buffett said in his annual letter. Shaw will spend $210 million on plant and equipment this year, Buffett said.

“We will come back big time on employment when residential construction comes back,” Buffett said. The unemployment rate will drop to 6 percent “within a few years,” he said.

Bloomberg News

Surging Yuan May Signal Boost For Global Recovery

(Bloomberg)The yuan’s strongest gain in more than three years may herald a new stimulus for a flagging global recovery as Chinese importers get more firepower to buy up goods from slowing economies in the U.S. and Europe.

The currency climbed 0.8 percent this week, more than any weekly increase since December 2007, breaking through 6.4 per dollar for the first time in 17 years. Today’s closing price in Shanghai was 6.3895. Yuan forwards had the biggest weekly gain since February 2009.

Chinese officials are allowing the currency to appreciate as slowing growth and gyrations in global currencies and stock markets threaten to spark a new recession. Besides countering inflation and accelerating China’s shift to domestic-driven growth, a stronger yuan may also signal a willingness to help shore up slumping confidence in the global economy.

“They may want to be seen as stepping up to the plate as the second-largest economy,” said David Cohen, an economist at Action Economics in Singapore who formerly worked for the U.S. Federal Reserve. “Inflation is also a little higher than they would want.”

During the global financial crisis, Premier Wen Jiabao’s government halted the yuan’s gains for almost two years, keeping the currency pegged to the dollar until June 2010. It has strengthened more than 6 percent since then. Reasons for allowing gains now include elevated inflation and a surge in the trade surplus in July.

Global Response

Barclays Capital analyst Chang Jian estimates that the currency will rise 5 percent to 7 percent over a year. That would help to boost demand that is already surging, with imports climbing 27 percent to a record $973 billion in the first seven months of 2011, according to trade data released this week.

On Aug. 9, China’s State Council urged global cooperation to counter turmoil in financial markets and endorsed a Group of 20 pledge to take “all necessary initiatives in a coordinated way” to support financial stability and growth. While developed nations are struggling, the Chinese economy may expand more than 9 percent this year, according to the median estimate in a Bloomberg News survey of economists.

This week’s accelerated gains may partly be a “show of confidence” and “an effort to not appear overly worried about short-term financial market developments,” said Sacha Tihanyi, a Hong Kong-based currency strategist at Scotia Capital, the investment banking unit of Bank of Nova Scotia.

Biggest Jump

The yuan rose 0.37 percent to close at 6.3945 in Shanghai yesterday, its biggest jump in nine months, according to the China Foreign Exchange Trade System. It touched 6.3895, the strongest level since the country unified official and market exchange rates at the end of 1993.

Zhang Xiaoqiang, vice chairman of the National Development and Reform Commission, said that the currency will appreciate “gradually,” state radio reported yesterday evening.

A front-page commentary in the China Securities Journal today said that the government may rely more on strengthening the yuan to ease inflation pressures, with the central bank cautious on raising interest rates because of the risk of attracting capital inflows.

The currency remains undervalued by 3 percent to 23 percent, depending on methodology, International Monetary Fund economists said in a report released last month.

Key Driver

Inflation that reached a three-year high of 6.5 percent in July is driving the gains, said Arjuna Mahendran, who is the Asian head of investment strategy at HSBC Private Bank in Singapore and helps manage about $499 billion. A side-effect is the boost to consumption as imports become cheaper for Chinese consumers, he said.

The IMF said last month that a stronger yuan would help to make the Chinese economy more stable by aiding a rebalancing of growth toward domestic demand and away from exports and investment. One aim is to limit the risk of any slump in Chinese growth that would reverberate through the global economy.

Wage increases and a stronger social safety net are also elements of a drive to boost consumption, laid out in a five- year plan running through 2015.

Thursday, August 11, 2011

Why contrarian investing is so difficult?

(1) Because we are too smart.

Please elaborate.

Our brains are very easy to be sold with good data, statistics and arguments.

When smart people open up newspaper and research papers, they find that it is so convincing and makes so much sense to explain how the market got flushed down the toilet.

How?

Chinese PMI drop below 50. That's signal contractions. Inflation above expectation signaling more tightening. Housing prices in major cities are still very firm. Property bubble is about to prick. Hard landing, got it????

PIIGS contagion will lead to sell off in emerging markets. Their banks refusal to loan will reduce liquidity. Those holding European assets will see their value dwindle. Lehman, remember?????

Unstable middle east, rioting are telling you price of oil will go up. Weak economy, high oil price, suicide okay????????

US government liquidity is no use because they don't have credibility. Forget about QE, they are pushing wet strings okay??????????

Japanese economy is already in recession. 10 more viagra tablets also cannot wake up, okay?????????

Everybody is overloaded and that will force to be disciplined with their fiscal expenditure. Consumer stop spending, government stop spending, who is going to spend??????

Projection of good negative arguments reinforced by downward stock market price makes so much sense.

(2) Uncle Faber and Rogers are on TV again

I have a lot of respects for these two gentlemen and they have been appearing on TV very regularly during the last 29 months of bull run but no one want pay attention to them. Suddenly all of us pay attention to them again.

Media will always want to you hear what you like to hear. When you think we are going for DOW 5,000, see faces of these two gentlemen will make their sales soar. Media won, investors lost!

(3) Our ancestors were not chimpanzee but cows and birds

The herding instinct makes up 99.99% of our DNA.

(4) lost money on Aug 5, Aug 9 and Aug 11. There must be no hope already.

O yea, I forgot to mention about capitulation. When investors capitulated, it does not mean that the market will not move lower. It will remain volatile for a while, could be days or even weeks. But when it start to run, the run can be sharp, 30, 40, 50% while many people will still call them "bear" market rallies.

(5) Investors/pundits already fully invested at the top and no more cash left.

So, they will sit down and curse and thinking the grapes must be sour.

(6) Valuation is too low, something must be wrong.

Stock market is a very efficient discounting machine. Earning will fall very badly soon.

Wednesday, August 10, 2011

Technical Rebound?

I was surprise and so surprise that the way people sell down their stocks like almost at the climax of a bear market but the indexes were hardly down more than 16 - 20 % from a peak which qualifies a bear market.

If one really want to reduce exposure and feel very bearish(which I am not), they should do it after the market rebound between 5 - 7% from yesterday close.

The way the markets sold down was not like pricing in a recession. It was like pricing in a default by the US and not a downgrade. They even associated the downgrade with Lehman default. Does it makes sense? Of course not!. I think the panics have gone too far. Found a good read. Don't like to use these words but this time is really different from 2008 melt down, in fact far from it!

(WSJ)It is a parallel that is seducing Wall Street bankers and investors: 2011 as a repeat of 2008, the history of financial turmoil playing in one endless loop.

As a big fund manager muttered darkly this past weekend while heading into the office to prepare for a tumultuous Monday, "The sense of déjà vu is almost sickening."

Those who think of 2011 as "2008—The Sequel" now have their very own "Lehman moment." Just substitute Friday's historic downgrade of the U.S. credit rating by Standard & Poor's for the collapse of the investment bank in September 2008, et voilà, you have a carbon copy of an event that made the unthinkable happen and spooked markets around the globe.

They got the last part right. Investors looked decidedly spooked on Monday with Asian and European bourses down sharply and the Dow tumbling 643.76 points, or more than 5%.

But market turbulence alone isn't enough to prove that history repeats itself.

To borrow a phrase often used to rationalize investment bubbles, this time is different, and the bankers, investors and corporate executives who look at today's problems through the prism of 2008 risk misjudging the issues confronting the global economy.

There are three fundamental differences between the financial crisis of three years ago and today's events.

Starting from the most obvious: The two crises had completely different origins.

The older one spread from the bottom up. It began among over-optimistic home buyers, rose through the Wall Street securitization machine, with more than a little help from credit-rating firms, and ended up infecting the global economy. It was the financial sector's breakdown that caused the recession.

The current predicament, by contrast, is a top-down affair. Governments around the world, unable to stimulate their economies and get their houses in order, have gradually lost the trust of the business and financial communities.

That, in turn, has caused a sharp reduction in private sector spending and investing, causing a vicious circle that leads to high unemployment and sluggish growth. Markets and banks, in this case, are victims, not perpetrators.

The second difference is perhaps the most important: Financial companies and households had feasted on cheap credit in the run-up to 2007-2008.

When the bubble burst, the resulting crash diet of deleveraging caused a massive recessionary shock.

This time around, the problem is the opposite. The economic doldrums are prompting companies and individuals to stash their cash away and steer clear of debt, resulting in anemic consumption and investment growth.

The final distinction is a direct consequence of the first two. Given its genesis, the 2008 financial catastrophe had a simple, if painful, solution: Governments had to step in to provide liquidity in droves through low interest rates, bank bailouts and injections of cash into the economy.

A Federal Reserve official at the time called it "shock and awe." Another summed it up thus: "We will backstop everything."

The policy didn't come cheap as governments world-wide poured around $1 trillion into the system. Nor was it fair to the tax-paying citizens who had to pick up the tab for other people's sins. But it eventually succeeded in avoiding a global Depression.

Today, such a response isn't on the menu. The present strains aren't caused by a lack of liquidity—U.S. companies, for one, are sitting on record cash piles—or too much leverage. Both corporate and personal balance sheets are no longer bloated with debt.

The real issue is a chronic lack of confidence by financial actors in one another and their governments' ability to kick-start economic growth.

If you need any proof of that, just look at the problems in the "plumbing" of the financial system—from the "repo" market to interbank lending—or ask S&P or buyers of Italian and Spanish bonds, how confident they are that politicians will sort out this mess.

The peculiar nature of this crisis means that reaching for the weapons used in the last one just won't work.

Consider Wall Street's current clamor for intervention by the monetary authorities—be it in the form of more liquidity injections (or "QE3") by the Fed or the European Central Bank.

Even if the central banks were inclined that way, pumping more money into an economy already flush with cash would provide little solace. These days, large companies are frowning all the way to the bank, depositing excess funds in safe-but-idle accounts, as shown by Bank of New York's unprecedented move last week to charge companies to park their cash in its vaults.

As for jittery investors, a few more billions minted by Uncle Sam or his Frankfurt cousin are unlikely to be enough to persuade them to jump back into the market.

In 2011, the financial world can't go cap in hand to the political capitals, hoping for a handout. To get out of the current impasse, markets will have to rely on their inner strength or wait for politicians to take radical measures to spur economic growth.

A market-led solution isn't impossible. At some point prices of assets will become so cheap that they will reawaken the "animal spirits" of both investors and companies.

As Warren Buffett once wrote to his shareholders, "we have usually made our best purchases when apprehensions about some macro event were at a peak".

The alternative is to hope that politicians in the U.S and Europe will introduce the fiscal and labor reforms needed to reawaken demand and investment growth. But that is bound to take time.

As often, the past looks a lot simpler than the present. But the reality is that, unlike 2008, governments' money is no good in today's stressed environment.

Monday, August 8, 2011

An/A Ignorant, heroic or calculated risk?

I put in a small sum of money for Turtle portfolio to demonstrate one point. Not all stocks are created equal. I find that people tend to abuse or quote Warren Buffett out of context.

Be fearful when others are greedy, be greedy when others are fearful.

It does not mean we can step in and buy any stocks indiscriminately. If we do, I think we are stupid. Very stupid. Again if we do, there is a good chance that we will lose money immediately the moment our buy transaction is completed because those penny or ACE stocks can fall further on the downside. Those are the stocks we must avoid during panic selling.

We also must not forget that Warren Buffett keeps saying he sticks with his circle of competence. Meaning he is watching a group of stocks(normally are so-called safe, with moat, etc) and high predictability that enable him to calculate the business value accurately using discounted-cash-flow. Please also not that not all stocks can use this method especially those belongs to unpredictable business model and etc....

With this in mind, if there is a group of stocks that are very defensive in nature like BAT, REITs, BJ Toto, Nestle, Star, etc fall big time, these are the stocks that we can step in and buy during panic selling. These are the stocks that I think will exercise my calculated risk.

From technical point of view, KLCI is testing on a very strong support around 1,474. Unless we see further nuclear-like bomb to shock the market, I think there is a good chance that it should bounce off from here(at least for the short-term). Failing to hold at this level, I think it will invite more selling. Watch this line very dilligently.

Friday, August 5, 2011

Wednesday, August 3, 2011

Some warning signs

The approval of raising debt ceiling turned out to be an anti-climax event. Good news turned into a major sell off is not a good sign. Those bet the market will turn favorably got burnt instead. The pundits are betting on a possibility of a recession next year. I am not ready to take any stance on this yet but Dow Jones Transportation broke the support yesterday did raise a little alarm. I was not sure whether this is a genuine signal or just a false alarm. Any way, I think yellow light signal is flashing. It does warrant some cautiousness.

Monday, August 1, 2011

Do not confuse Soro's retirement = hopeless future

I truly admire his approach. It is not easy for people to let go when you are at your highest form. It takes tremendous amount of humility to bow out and close the final curtain. Some intepret his retirement is a turtle approach(hiding his head in his shell). At least this is what Market Watch perceives him in this headline "Soros’s decision protects money, legacy, influence"

(Market Watch) Don’t-mess-it-up money is the amount someone needs to be secure for the rest of their lives, to protect their dreams and aspirations, to ensure that they can withstand inflation and market woes while maintaining the peace of mind that they are set for life.

The rest of their assets? They could invest in scratch tickets or gamble at the track, bury it in the backyard or throw into equities, but their legacy and life’s work are safe.

George Soros, one of the world’s most famous investors and leading philanthropists, appears to have decided that, given current market conditions, he no longer wants to run the risk of messing things up. The media is reporting that the 80-year-old billionaire hedge-fund magnate is shutting down his hedge-fund operations and returning outside investors’ money. Read our report on Soros’s decision to wind down his hedge fund.

Soros’s sons said in a letter that the firm will continue to operate as a family business.

Clearly, Soros has enough money, power, prestige and respect. About all that could happen now is that he messes up his legacy, hurts his stellar track record and makes headlines that somehow detract from his political influence and philanthropic aims.

Soros made headlines late last year when he called gold “the ultimate bubble” and by early this year he had sold most of his firm’s stake, all while gold was still on the upswing. His history shows that the more turbulent the market, the less performance edge his funds deliver, and the market may never have been more unpredictable in his long investment career than it is right now.

At his age and with his legacy at stake, it seems like the ultimate sophisticated investor is acting like the average guy, and making sure that what he values the most — and what is most important to his future — is safe.

A lot of average folks, while lacking Soros’s resources, might at least want to look at the current market with the same concerns in mind.

I disagree that Soros winding down his fund is a sign of hopeless future(no money to be made kind of scenario). Everyone needs a retirement -- to stop playing the game that you are very good at, of course it has to be at the right time. At the time when tickets are fully sold out.