Before we jump in with two feet, we must understand he got himself hell of good deals - guarantee of 10% dividend as preference shareholder for GE for example. This kind of deal you and I will never get. When a TV broadcaster asked Jim Rogers what he thinks of Buffett deal on Goldman Sachs. She was alluding to worst of financial crisis will be behind us soon. Jim shouted back that Buffett got such a good deal, so why not?

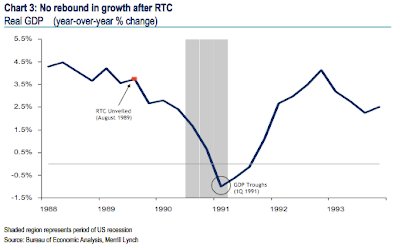

I saw a few charts released by David Rosenberg an analyst with Merill Lynch the worst is not over. During the S & L crisis in early 90s, the market did not bottom out after the US government announced the bailout in August 1989. The market took almost 16 months later. The S & P was around 350 points in August 1989 and bottomed out around 300 points in October 1990. That was approximately 14% drop.

The US economy was not in recession just like we have not seen any negative GDP number so far. The recession was not trough until more than one year later.

Back to Buffett sharpness to time the market, between 1 Jan 1989 to 31 December 1990, he did not add much large positions to his portfolio. He spent only about US $ 341 million on Coca-Cola. That means he did not believe the worst was over despite of the bailout. In 1990, the year S & P bottom out he did not add any large positions. However, a few months later, in 1991 he added Gilette US $ 600 million and Guiness US $ 265 million to his portfolio, which was much more aggressive compared to a year before. He believed the worst was over in between 1990-91 - he was correct!

If Buffett is right again this time, are we going to see sunny days - happy smiling faces again?

NEW YORK (CNNMoney.com) -- The Senate on Wednesday night passed a sweeping and controversial financial bailout similar in key ways to one rejected by the House just two days earlier.

The measure was passed by a vote of 74 to 25 after more than three hours of floor debate in the Senate. Presidential candidates Sens. Barack Obama, D-Illinois, and John McCain, R-Arizona, voted in favor.

Like the bill the House rejected, the core of the Senate bill is the Bush administration's plan to buy up to $700 billion of troubled assets from financial institutions.

Those assets, mostly mortgage-related, have caused a crisis of confidence in the credit markets. A major aim of the plan is to free up banks to start lending again once their balance sheets are cleared of toxic holdings.

Well, if history is going to be our guide, worst case scenario - a potential downside of another 10-15%. Though I am still bearish, if we have the cash and stomach for it, spending little bit of money may not hurt us, right?

1 comment:

We have been discussing at My Investors Place Buffetts purchase of Goldman and now GE... we think he is following in the steps of Ben Graham his teacher that it took 10 years for him to get back to break even... More so ...he recently stated we are in the equivalent of a " Financial Pearl Harbor"...so why is he buying?? AS you stated ..he has spent a large part of his fund... What does he know that we don't?

What are we missing...

What is your opinion???

Post a Comment