Among all the offshore service players, Bumi Armanda has the strongest fundamentals.

Background.

It has four business units as you can see in this screen short.

A lot of abreviations here but we have no choice but to know a few of them.

FPSO(Floating Production, storage and offloading system).

OSV(Offshore vessel)

T&I(Transportation and installation).

Revenue Mix

Almost 80% of the revenue are coming outside Malaysia. This is what I like about them. They have proven themselves to compete internationally.

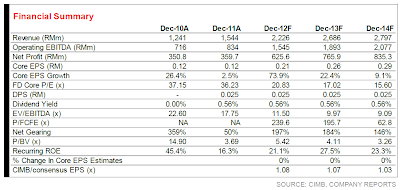

The financial snap shot.

The valuation is certainly rich. I do not intend justify the high valuation or high premium. I do not think it is justifiable to tag 22X PE to 2012 earning. If we were to compare to other regional players, 12 - 14 X are already considered very rich. At the current price, we are pricing in all the way into 2015. Despite of the stock is fully valued, I just want to highlight a few strong points so that it will be handy if the share price happens to come down to around RM 3 to RM 3.3/share.

Strong points:

1. Strong earning visibility. Bumi's order book stand at RM 7.6 billion with RM 3 billion extension option. Many of the contracts are long term in nature. They look busy in the next 3, 5 or 7 years ahead?

2. Strong liquidity -- free float of 55% will attract fund managers. On off contract announcements/news flow may spice up the share price??

3. I like their business strategy. It is crystal clear, isn't it?

4. Strong relationship with NOCs and Petronas especially. It is certainly not easy to navigate in emerging markets that full of uncertainty and political land mines but the risks are certainly equal or greater than opportunities. The reason? Malaysia politics is certainly one of the hardest to deal with as well. I'm pretty sure our pretty "screw up" business environment already given them a good training ground. ( I don't think I want to explain it too explicitly so that I don't get into trouble. Read in between the lines, okay???)

5. It may be too text bookish to say that they have strong management but based on what I read from their public reports, this company is certainly lead by very competent with strong international exposure management.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment