However, recently(May '08) in a filling to SEC indicated Buffett cut his stakes in Ameriprise from 661,742 shares to 0 shares. Interesting, he still keep a small portion of it then.

Ameriprise Financial, Inc. provides financial planning, asset management, and insurance services to individuals, businesses, and institutions.

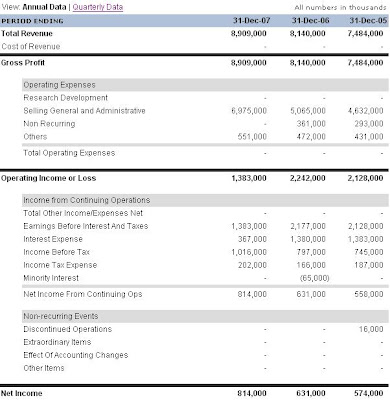

Taking a look at the financial performance of the company, the company is still fundamentally sound. Net income was growing steadily but SGA was ballooning. You can see operating income actually dropped sharply despite of rising Net income.

Valuation wise seems to be OK - no signs of extreme optimism. Geez, these investing stuffs are really confusing, Yup - I've told you so!. If it is not valuation, it must some other issues. What could the reasons of him sold the shares?

Buffett is seems like really wired to see future, you can see very clearly he exited in a big way before fundamentals deterioration become crystal clear to you and me. He deserves to be a billionaires for this.

Anyway, my take is the company was over expanding chasing for very limited or declining growth before sub-prime mess blow up. Separations cost will eventually show up if the company management decided to trim its workforce. It is a strong hint Buffett is quite bearish financial services sector. Another lesson learned - sell is permissible when growth prospect is dimming. You need to bet on the industry and company fundamentals momentum and not price momentum! Read the last sentence again.

No comments:

Post a Comment